Category: Benefits and Compensation

This topic provides guidance on how to handle compensation issues in a way that attracts and retains the best talent and advances the strategic goals of your business. You get news and tips on what’s going on nationally and in the states, and updates on changes in regulations, possible governmental action, and emerging compensation trends.

[Go here for the first part of the discussion on pregnancy discrimination] Requiring Leave May an employer require a pregnant employee who is able to perform her job to take leave at any point in her pregnancy or after childbirth? No. An employer may not force an employee to take leave because she is or […]

On July 14 the Equal Employment Opportunity Commission (EEOC) issued enforcement guidance on pregnancy discrimination accompanied by an extensive and practical Q&A. The new guidance, the first to address pregnancy discrimination since 1983, focuses on how the 2008 amendments to the Americans with Disabilities Act (ADA) may apply to employees with pregnancy-related disabilities. Is EEOC […]

[Go here for 2014 data and the rest of the survey results] 2015 Merit Increases A mere 13.8% (down from 14.1% in 2013) of survey participants have decided and/or approved their pay budgets for 2015, leaving 86.3% undecided as of the end of June. Of those who have decided, on average across all employee types, […]

Yesterday’s Advisor began our coverage of BLR’s 2014–2015 Pay Budget Survey results. Today, the rest of the results, including 2015 compensation planning. [Go here for 2014 data and the rest of the survey results] 2015 Merit Increases A mere 13.8% (down from 14.1% in 2013) of survey participants have decided and/or approved their pay budgets […]

More needs to be known about managed account services for retirement plan participants and the role employer plan sponsors play in offering them, according to a report released on July 29 by the U.S. Government Accountability Office. Because these services differ from investment options provided within 401(k) plans, yet can serve as a qualified default […]

A federal appeals court not only affirmed a ruling that an employer/plan administrator must pay more than $126,000 in penalties and legal costs for intentionally violating COBRA notice requirements, it also held that about $2,460 in expenses excluded from the legal award should be revisited by the lower court. The case is Evans v. Books-A-Million, […]

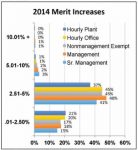

Highlights of the survey: 18.2% of respondents are awarding merit increases (averaged across all employee types) of up to 2.5% in 2014 and 46.1% are awarding increases of more than 2.5% 21% of survey participants awarded an increase of 2.51–3% for “Meets requirements” and 12.9% awarded that amount for “Exceeds requirements.” The biggest challenge for […]

When investigating a breach of IT network security leading to leakage of protected health information, HHS looks for consistency in the covered entity’s response — with both HIPAA rules and the organization’s own written procedures, according to a former official with HHS’ Office for Civil Rights. OCR tends to “expect a perfect assessment done the […]

By Peter A. Susser Federal contractors’ administration of family leave will face unprecedented scrutiny as a result of a new executive order from President Obama. The order requires the disclosure of labor law violations committed by would-be contractors, and a determination of whether that candidate is satisfactorily responsible and ethical. The order is […]

In a decision sharply at odds with a recent Illinois ruling, a federal district court in Arizona held that health care providers cannot be characterized as plan beneficiaries who can sue to compel payment of ERISA benefits. The court rejected the view that a direct payment for services is an ERISA benefit that give providers […]