Category: Benefits and Compensation

This topic provides guidance on how to handle compensation issues in a way that attracts and retains the best talent and advances the strategic goals of your business. You get news and tips on what’s going on nationally and in the states, and updates on changes in regulations, possible governmental action, and emerging compensation trends.

Please participate in our brief survey and see how what you are doing stacks up against what other successful companies are doing. We’ll get answers to these questions and more: How often are appraisals conducted? What specific characteristics/abilities/behaviors do you measure? If you use software, which software program do you use? How is your performance […]

Benefits often make a real difference in attraction and retention. Here’s how you compare on perks from health insurance to stock options to paid vacation. Highlights of our 2014 Perks Survey of over 2,000 employers: The number one perk is paid holidays. Also in the top five: life insurance, LTD, STD, and paid vacation. For […]

The first thing to recognize about compression is that there are no secrets at work, says consultant Brown. People are going to find out what other people make. They may talk openly or it may be relatively innocent, he adds. For example, your life insurance is half of salary, and employees are sitting at lunch […]

Of course, it may be that your compensation program is flawed, but it’s more likely that the survey the employee is referencing is flawed or inappropriate, says Brown of Effective Resources, Inc., who delivered his tips at a recent BLR-sponsored webinar. It may be a bad survey that just wasn’t done well, or it may […]

Pay surveys are an important tool for developing and maintaining pay plans that fairly reward employees without breaking the bank. But where should the information come from? Should it be gathered by someone in-house? Or paid for from a consultant? What are the options?

Pay surveys are an important tool for developing and maintaining pay plans that fairly reward employees without breaking the bank. But where should the information come from? Should it be gathered by someone in-house? Or paid for from a consultant? What are the options?

Payments by qualified retirement plans for accident or health insurance will be taxable distributions to participants in most cases, starting with the 2015 tax year, according to new IRS final regulations. Retirees are excluded from having to pay tax on plan payments for medical benefits, however. IRS on May 6 approved amendments to 26 C.F.R. […]

Vacation time and paid holidays may be a relatively standard benefit to offer to full-time employees, but in the United States, it’s not actually legally mandated. While many employers are well aware of this, it’s important to make a note of, since employees often treat it as a right. In fact, vacation time is typically […]

It’s prudent to pay close attention to travel pay regulations because travel-related issues pose a significant risk for wage and hour claims. This is, unfortunately, an often-overlooked area.

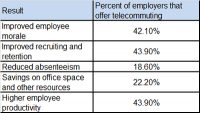

[For the beginning of the survey report, go here.] Telecommuting Formal telecommuting guidelines are in place and employees are required to sign a formal agreement for 23.8%. An allowance to cover employee expenses for setting up telecommuting at their home is provided by 33.1%, 40.3% reimburse telecommuting employees for monthly Internet connections, and 54.2% reimburse […]