Category: Benefits and Compensation

This topic provides guidance on how to handle compensation issues in a way that attracts and retains the best talent and advances the strategic goals of your business. You get news and tips on what’s going on nationally and in the states, and updates on changes in regulations, possible governmental action, and emerging compensation trends.

“I’m grossly underpaid as these surveys show,” says your employee as he or she comes down the hall armed with a pile of downloaded survey data. Consultant Barry L. Brown, SPHR, CCP, has a plan for blunting these attacks. Of course, it may be that your compensation program is flawed, but it’s more likely that […]

In yesterday’s Advisor we discussed straight and hurdle-rate profit-sharing; today, goal-driven profit-sharing plans. [Go here for 1. Straight and 2. Hurdle-Rate Profit Sharing] 3. Goal-Driven Profit-Sharing Plans In a goal-driven profit-sharing plan, profits are used to establish an incentive opportunity, but employees also must earn that opportunity, based on achieving other goals. These other goals […]

When you consider a profit-sharing plan, there are three main ways to set it up: straight, hurdle, and goal. A profit-sharing plan is a group incentive plan that includes all employees in an organization and that focuses on overall business unit profit (or a similar bottom-line financial goal). What are the advantages and disadvantages? Advantages […]

In a recent conversation with an organizational psychologist, I was asked, “What are the top three things you look for in the members of your management team?” That’s a big and important question. Yet I was able to answer it quickly and easily: “Trustworthiness, compatibility, and talent.” The next sentence I uttered might surprise you; […]

Employers have cited complying with the Affordable Care Act as their number one concern in surveys, and that wouldn’t be the case if there weren’t taxes and money penalties backing it up. This is true even though the government postponed until 2015 penalties for failure to comply with the ACA’s play-or-pay mandates, temporarily reducing the […]

[Go here for 1. Straight and 2. Hurdle-Rate Profit Sharing] 3. Goal-Driven Profit-Sharing Plans In a goal-driven profit-sharing plan, profits are used to establish an incentive opportunity, but employees also must earn that opportunity, based on achieving other goals. These other goals are broad corporate goals, rather than unit operational goals, which are used to […]

Advantages Funded from profits, so there is low risk for the company. Can be used to supplement company retirement contributions. Can be linked to company objectives other than profit. Provide an opportunity to train employees on financial measures and the operational business factors that affect those measures. Easy to integrate with suggestion plans and other […]

Employers often find themselves in a conundrum, however, over how to handle miscellaneous time off that was never even requested as PTO. For example, what happens when the work hours are 8 a.m. to 5 p.m., but an employee has a personal appointment that requires him or her to arrive late? Usually this is not […]

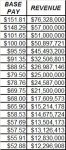

A nonprofit home healthcare agency has asked “a consultant” whether its CEO is fairly paid relative to the marketplace for similar agencies. The Agency has supplied a database to the consultant, who also has his own survey database of CEO pay. This case will demonstrate how regression data can be used to answer this question. […]

What Is Regression Analysis? Regression analysis is a statistical technique that predicts the level of one variable (the “dependent” variable) based on the level of another variable (the “independent” variable). In a compensation setting, for example, that might be the relationship of executive pay to company size or company revenue. David Wudyka, SPHR, MBA, BSIE, […]