This topic provides guidance on how to handle compensation issues in a way that attracts and retains the best talent and advances the strategic goals of your business. You get news and tips on what’s going on nationally and in the states, and updates on changes in regulations, possible governmental action, and emerging compensation trends.

If the economy continues to improve, employers may be headed to what the most pessimistic call “Turnover Armageddon.” What can you do to prepare? If your organization is like most, workers have been patient about compensation for several years of low or no raises. They understood that their organizations were squeezed by economic pressures, and […]

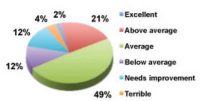

Some other highlights of the 2013 Performance Management Survey: Employee self-evaluation is part of the process for 58% of respondents and peer evaluation is a best practice for 11%. 22% believe that the employees in their organization are pleased with their individual pay-for-performance program. 13% impose financial penalties on managers and supervisors who do not […]

An increasing number of employers are examining providing a low-benefits health plan that covers only preventive health services but not high-price major medical claims. Offering this type of low cost or “skinny” plan is allowed under the health reform law. The question is: Will skinny plans trigger a large-employer exodus to de minimis coverage, and if so, […]

Health reform fees that health insurers and self-funded plans must pay in order to fund the Patient-Centered Outcomes Research Institute are “ordinary and necessary business expenses,” and therefore qualify as deductible from federal taxes, a recent IRS memo states. Insurers and health plans will pay the $1 (soon to become $2) per covered life fee […]

In yesterday’s Advisor, WorldatWork’s Kerry Chou offered the four top reasons that key talent leaves organizations. Today, what strategies are working, plus an introduction to a highly practical collection of prewritten, ready-to-use HR policies. What Strategies Are Working? WorldatWork surveys have shown the following percentages of respondents who said the tactic was “very effective” or […]

Click through this slideshow to learn what wage and hour myths your managers might be falling for right now.

The job market is always hot for key talent, says WorldatWork’s Kerry Chou, and with the economy improving, it’s just going to get worse. Chou, who is Senior Practice Leader, Compensation, at WorldatWork, offered his tips at WorldatWork’s Total Rewards 2013 Conference and Exhibition, held recently in Philadelphia. Why Key Talent Leaves Employers are always […]

Creditors of retirement plan participants sometimes try to tap into a participant’s supplementary benefits under various legal arrangements, including garnishment and domestic relations orders. If a plan administrator or adviser is faced with the prospect of a participant’s deferred compensation being assigned to a creditor, the administrator must be familiar with a number of complicated […]

Concerns about the effect of lump-sum retiree distributions on the funded status of defined benefit pension plans with ongoing obligations to future beneficiaries were prominent as members of the ERISA Advisory Council tackled issues of “derisking” at a June 5 open meeting at the U.S. Department of Labor. There was high interest in the topic […]