Category: Benefits and Compensation

This topic provides guidance on how to handle compensation issues in a way that attracts and retains the best talent and advances the strategic goals of your business. You get news and tips on what’s going on nationally and in the states, and updates on changes in regulations, possible governmental action, and emerging compensation trends.

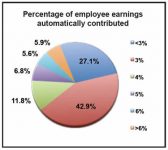

Only 33% of those who answered the question, however, automatically enroll employees, though 2.5% plan to implement auto-enrollment in the future. Other survey highlights: Most common match amount is up to 6% of salary (25% of respondents). Nearly half (48%) of employers offer more than 15 investment options. 26% plan to add a defined contribution […]

Employer-sponsored plans that are secondary to Medicare are not subject to health reform’s expensive transitional reinsurance fee, nor are health flexible spending arrangements, health savings accounts and most health reimbursement arrangements. On March 11, 2013, the U.S. Department of Health and Human Services published its final regulation on the transitional reinsurance fee, which takes effect […]

Three monthly measures of defined benefit pension plans’ funded status slipped or remained flat in February after a strong start to 2013, due mostly to weakening interest rates. The Milliman 100 Pension Funding Index, which monitors funding for the U.S.’s largest corporate DB plans, posted a decrease in funded status for the month to 81.5 […]

Your wellness program may get much more important under the Affordable Care Act (ACA), says Morris, a member of the firm Epstein Becker Green in its Washington, D.C., office who specializes in benefits. There are already many benefits to wellness programs, but Morris is convinced they will become even more crucial as the ACA unfolds […]

These questions and answers on the Small Business Health Care Tax Credit are adapted from the IRS web site for companies considering getting federal subsidies to help pay premiums for their workers to get health insurance. The subsidies are authorized by health reform law. Q: Which companies qualify for a federal health care tax credit? A: […]

Review of Charge Activity, Backlog, and Benefits Provided On November 19, 2012, the EEOC announced the publication of the FY 2012 Performance and Accountability Report. During FY 2012, the Commission again received nearly 100,000 charges, with the past 3 years involving a record number of charges in the Commission’s 47-year history. Since FY 2006, there […]

Most companies are looking at around 3 percent for their merit budgets, says consultant Terry Pasteris, but they’re wishing they had 5 percent. In today’s Advisor, how she makes that (appear) to happen, plus an introduction to the all-comp-in-one-place website, Compensation.BLR.com. Salary Increase Budget Surveys Most employers are working with 3 percent for merit, as […]

As defined benefit plan sponsors look harder for ways to cut expenses and lower exposure to market forces that challenge keeping their pension obligations funded, an obvious cost to evaluate is their commitment to lifetime retirement benefits for participants. Nearly 40 percent of U.S. employers with DB plans told Aon Hewitt in its recent 2013 […]

A health reform requirement that all insurers offer four levels of health coverage to small businesses would be delayed until 2015 under proposed rules scheduled to be published March 11 in the Federal Register. Under the U.S. Department of Health and Human Services proposal, small employers may get one choice of health coverage in 2014. […]

Why Pay Is an Easy-to-Litigate Issue Harassment (“He made me uncomfortable”) is vague and often tough to prove, and discrimination (“You didn’t hire me because I am a member of a protected class”) is also hard to prove. But with pay issues —it’s there in dollars and cents for the agency rep or a jury […]